Examples of side businesses are plenty including online stores on e-commerce platforms blogging. Do I need to file a tax return for a sole proprietorship with no activity.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here is the step-by-step guide for the e-Filing process.

. A 10-digit number assigned by SARS to each taxpayer upon registration as a taxpayer is known as an income tax reference number. They can be registered with the Suruhanjaya Syarikat Malaysia SSM whether as a sole proprietor or partnership business as doing so will entitle you to some tax incentives that are inaccessible to taxpayers with non-business income. Companies limited liability partnerships trust bodies and cooperative societies which are dormant andor have not commenced business are required to register and furnish Form E with effect from Year of Assessment.

File your income tax online via e-Filing 4. LLCs that are taxed as sole proprietorships are exempt from filing an annual federal business tax return during years in which. After youve gotten your PIN you can go to the LHDN website and click on myTax.

You must be wondering how to start filing income tax for the. Non-resident individual who carry on business with employment income or others The residency status of individuals is subject to Section 7 Income Tax Act 1967. An individual who earns an annual employment income of RM25501 after deducting EPF contributions or more is required to file a tax return.

E-BE if you dont have business income and choose the assessment year tahun taksiran 2015. Fill in the required details and attach your Form CP55D. If youve just entered the workforce and have absolutely no idea how all this works heres a handy guide.

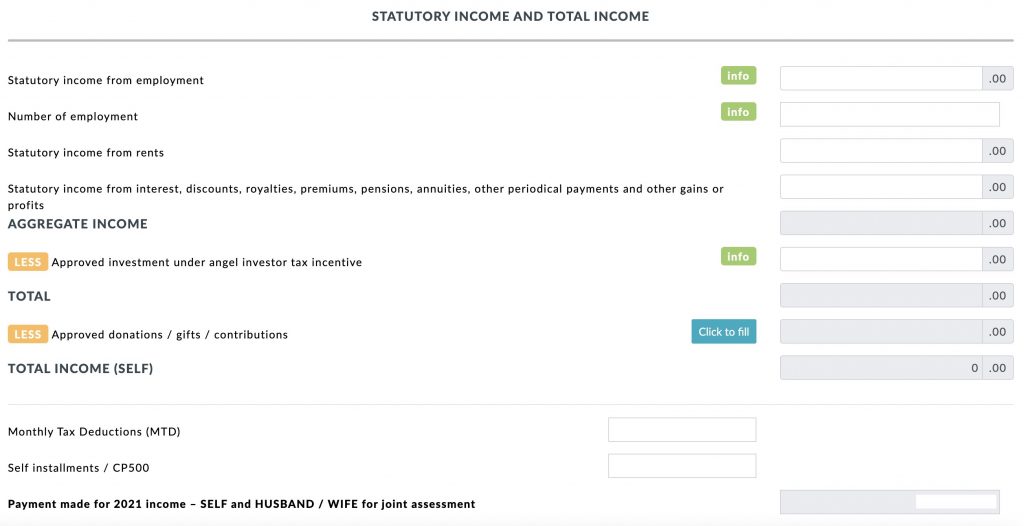

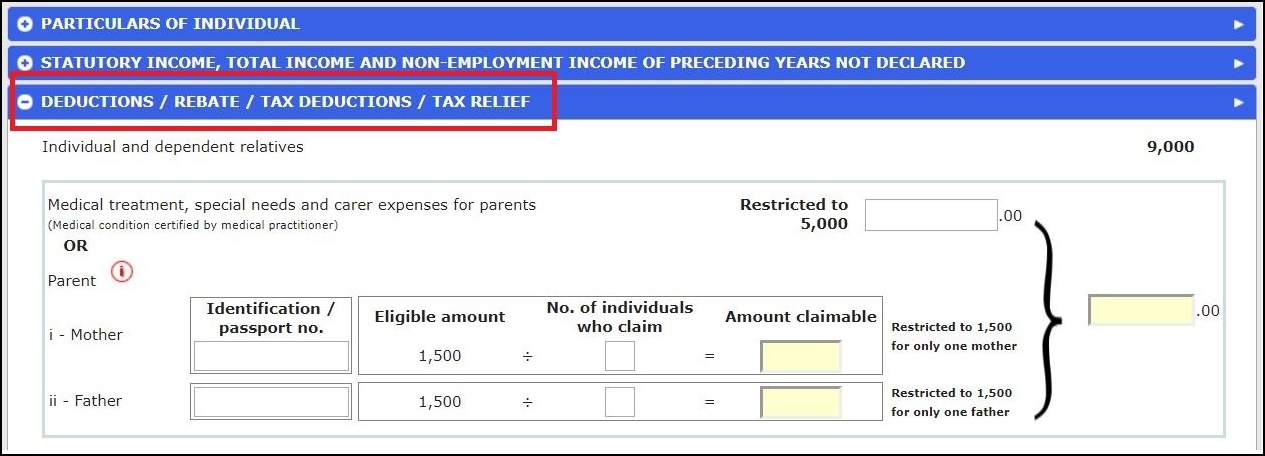

How To Pay Your Income Tax In Malaysia. As the taxable value is between 15 to 25 lakhs so that 5 will apply to income. Fill in your tax reliefs tax rebates and tax exemptions.

Non-resident stays in Malaysia for less than 182 days and is employed for at least 60 days in a calendar year. Taxable income is now extracted from gross income which is 219000. In the event that you are registered you may find your tax number on your Income Tax Workpage on eFiling provided you are an authorized eFiler.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Non-residents are taxed a flat rate based on their types of. Check your personal details.

Fill in your income details. On the other way round according to the Income Tax Act 1967 only income derived from Malaysia is subject to income tax in Malaysia while income earned outside Malaysia is not. In Malaysia income tax is compulsory by law and the income tax you pay differ based on your total taxable income for the year.

For the BE form resident individuals who do not carry on business the deadline falls on either 30 April 2022 manual filing or 15 May 2022 e-Filing. First is to determine if you are eligible as a taxpayer 2. Where a company commenced operations.

Choose your corresponding income tax form ie. They need to apply for registration of a tax file. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021 for manual filing and 15 May 2021 via e-Filing.

Taxable income is on which we apply the tax Tax is 5 on income below 250000. You can either visit the LHDN Customer Feedback website and. Meanwhile for the B form resident individuals who carry.

Once youve logged in under the e-filing section click on e-Borang and that will take you to your tax e-filing form. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. How To File Your Taxes Manually In Malaysia.

How To File Income Tax As A Foreigner In Malaysia. Register for first-time taxpayer online via LHDN MalaysiaA. How to File Income Tax in Malaysia 2022 LHDNAre you filing your income tax for the first time.

Write the formula B2-B3-B4 inside the formula bar and press the Enter key. Resident individual with employment income and does not carry on business. Foreigners who stay and work in Malaysia for more than 182 days are subject to tax and they must file and pay their tax to the Inland Revenue Board of Malaysia.

Go to e-Filing website. Login to e-Filing website. Click on Permohonan or Application depending on your chosen language.

If you are not registered you can find your tax number on your tax return. Ensure you have your latest EA form with you 3. As for those filling in the B form resident individuals who carry on business the.

In the textbox labeled Enter your User. Foreigners who qualify as tax-residents follow the same tax guidelines progressive tax rate and relief as Malaysians and are required to file income tax under Form B. Access the official Income Tax Department Portal by going to the URL httpswwwincometax govin and clicking on the Login Here link on the homepage of the website.

Resident individual who carry on business with employment and other income. Guide To Using LHDN e-Filing To File Your Income Tax. Alternatively you can either check online via e-Daftar or give LHDN a call at 03-89133800.

Go back to the previous page and click on Next. The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Make sure to click on First Time Login if youre a first-timer.

Mar 08 2022. Amending the Income Tax Return Form. Key in your MyKad identification number without dashes and your password.

After registering LHDN will email you with your income tax number within 3 working days. To register or log in to your e-Filing for the first time youll need a PIN provided by the LHDN. Tax Offences And Penalties In Malaysia.

Choose the right income tax form. Note that you can toggle between BM or English for the website. Verify your PCBMTD amount 5.

2 Time to start filing. Maximising your tax relief and rebates to get your money back 6.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

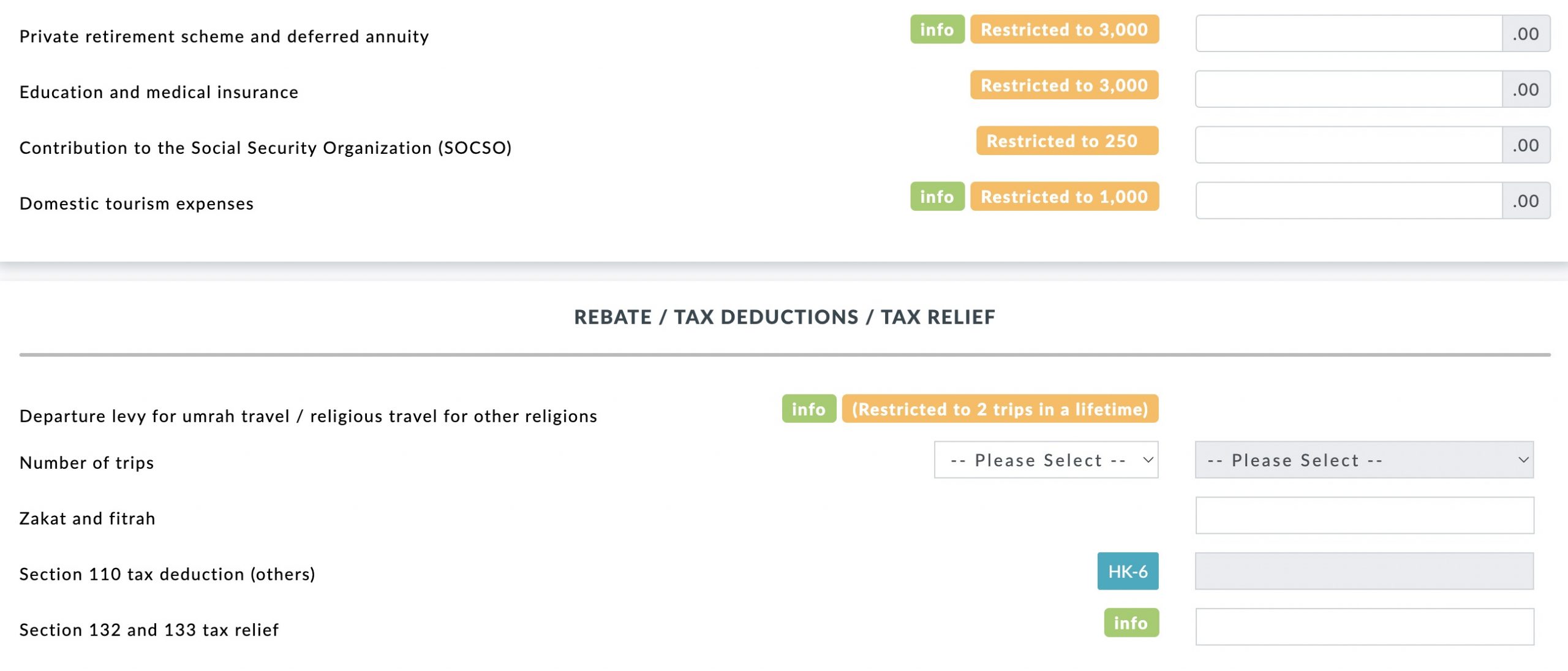

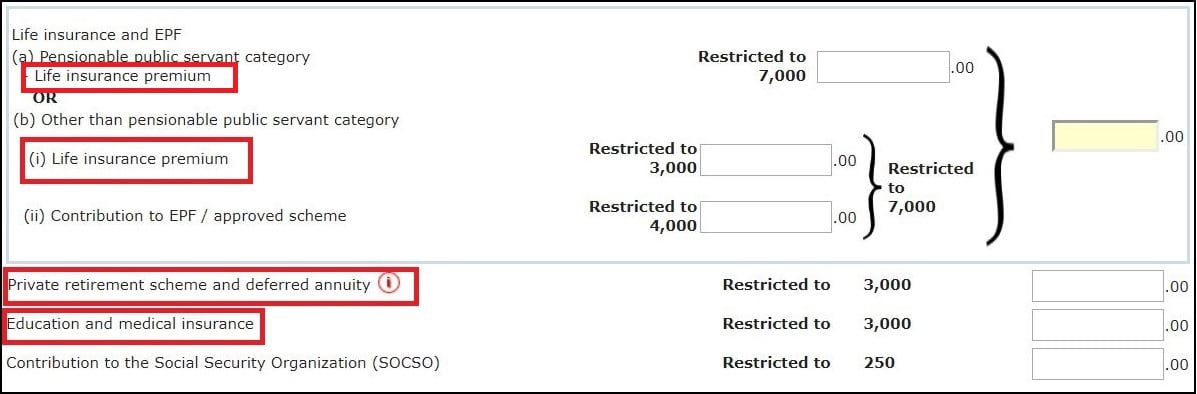

How To Claim Income Tax Reliefs For Your Insurance Premiums

7 Tips To File Malaysian Income Tax For Beginners

7 Tips To File Malaysian Income Tax For Beginners

5 Difference Between Elss Vs Ppf Vs Nsc Vs Tax Saving Fixed Deposit Nri Saving And Investment Tips Savings And Investment Income Tax Tax Free Savings

How To Sell Online Payslips To Your Employees Payroll Payroll Template National Insurance Number

How To File Your Taxes If You Changed Or Lost Your Job Last Year

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Income Tax Filing In Malaysia Income Tax Filing Taxes Online Taxes

How To Claim Income Tax Reliefs For Your Insurance Premiums

How To File Your Taxes For The First Time

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Individual Income Tax In Malaysia For Expatriates

The Complete Income Tax Guide 2022

Guide To Using Lhdn E Filing To File Your Income Tax

How To Claim Income Tax Reliefs For Your Insurance Premiums

Gauravshahgs I Will Do Accounting Book Keeping And Tax Consultancy For You For 30 On Fiverr Com Accounting Books Tax Consulting Accounting

How To Step By Step Income Tax E Filing Guide Imoney